This post has my personal notes from the book ” Winning the Loser’s Game” by Charles Ellis where he elaborates about timeless strategies for successful investing.

THE LOSER’S GAME

Investment management is based on the belief that investors can beat the market. This may have been true in the 1950s and 1960s but is false even for the most professional investment. The reasons for this are simple. When you buy and sell, you incur costs. To beat the market before costs and taxes may be possible. To beat the market after costs and taxes is impossible for most investors. The reason for this is because there are many professionals in the investing business and they all are skillful and have access to the same knowledge. They cannot hit more ” winners” than the others to win the game of investing. If professionals cannot win the game, the chances for the individual investor are slim. But there is another way. The way is to set realistic long-term investment policies and follow them with persistence and self-discipline.

BEATING THE MARKET

Active management tries to succeed with any or all the four investment approaches:

- Market timing.

- Selecting specific stocks or groups of stocks.

- Making timely changes in portfolio structure or strategy.

- Developing and implementing a superior, long-term investment concept or philosophy.

Market timing does not work in reality, even though there are many theories on paper that are shown to work. Many people do investment research very well, making selection of specific stocks or groups of stocks not useful. Changing strategy or portfolio structure may work in the short run but in the long run very few succeed and it is difficult to identify them beforehand. Very few, if any, superior investment concepts exists because of an very efficient free capital market.

But there are ways to achieve success as a long-term investor. One way is to reduce risks and errors. Do not take too much risk. Do not take too little risk either(by investing in cash and bonds). Remember that most trading is done by institutions and these pros have better trading skills on average. So do not actively trade and lose.

We should understand the four powerful truths about investing:

- The dominating reality is that the most important investment decision is your long term mix of assets: how much in stocks, bonds, real estate or cash.

- That mix should be determined partly by the real purpose- growth, income, safety, and so on- and mostly according to when the money will be used.

- Diversify within each asset class and between asset classes. Bad things do happen- usually as surprises.

- Be patient and persistent. Good things come in spurts-usually when least expected- and fidgety investors fare badly. “Plan your play and play your plan,” say the great coaches. ” Stay the course” is usually wise. So is setting the right course- which takes you back to #1.

When you try to invest actively, you usually go against these truths by paying higher fees, taxes and lots of emotional energy. We have to be realistic about investing and adopt a long-term investment program to achieve the goals we want to achieve.

MR. MARKET AND MR.VALUE

Mr. Market and Mr. Value are the two personalities of the market. Mr. Market is emotional and Mr. Value is rational. In the long-term Mr. Value wins. Things which are overpriced come to fair value and things which are underpriced come to fair value. However what is the real value is difficult to identify except at extremes. The main problem is that Mr. Market plays into our emotions of fear and greed and makes us do wrong things-buy high and sell low. The way to prevent this is to have an optimum investment policy, and more importantly, to stick to it for the long-term-no matter what.

THE INVESTOR’S DREAM TEAM

There are many advantages to buying the market by indexing. They are:

- You can have all the best professionals working for you( the investor’s dream team), because the market is composed of all these professionals and you have their most uptodate consensus when you index.

- You have peace of mind because investing has been made very simple.

- You have lower fees, lower taxes and lower “operating expenses”.

Almost all active investors will underperform the market over long periods of time. The few who do outperform cannot be predicted in advance. The market is very efficient and superior knowledge and skill are rare, if they really exist. Even Warren Buffet recommends that,

“Let me add a few thoughts about your own investments. Most investors, both institutional and individual, will find that the best way to own common stocks is through an index fund that charges minimal fees. Those following this path are sure to beat the net results( after fees and expenses) delivered by the great majority of investment professionals.”

INVESTOR RISK

We are not always rational and we do not always act in our best interests. We do a lot of things that prove this:

- We ignore the “base rate” or normal pattern of experience. We gamble at casinos and get caught up in bull and bear markets.

- We believe in “hot hands” and winning streaks and that recent events matter.

- We are overly impressed by short-term results.

- We look for data and overweight the significance of data that support our own initial conclusions.

- We use early ideas or numbers as reference points for future decisions.

- We believe that we are better than we really are. We don’t learn. We are overconfident.

- We confuse familiarity with knowledge and understanding.

- We think we know more relative to others than we really do. We also think we are “above average”.

To avoid doing these things, we need to avoid:

- Trying too hard.

- Not trying hard enough( by having too much in money market or bond funds)

- Being impatient. If you make an investment decision more than once a year or so and are not devoting full time to the market, you are surely being too active in trading, and it will cost you.

- Making mutual fund investment changes in less than 10 years.

- Borrowing too much.

- Being naively optimistic.

- Being proud. We should not overestimate our performance relative to the market. We need to recognize and acknowledge our mistakes.

- Being emotional. Don’t be greedy when your stocks rise. Don’t be fearful when your stocks fall.

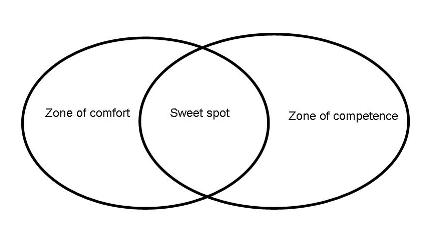

As investors, our success is determined by our intellectual capabilities( our knowledge of finance and investing) and our emotional capabilities( our ability to remain calm and rational). We all have a zone of competence( the kind of investing for which he or she has real skill) and a zone of confidence( the area of investing in which she will be calm and rational). The place where they overlap is your sweet spot and you should stay there: investing only when you know from experience that you have the requisite skill and can be consistently rational.

YOUR UNFAIR COMPETITIVE ADVANTAGE

YOUR UNFAIR COMPETITIVE ADVANTAGE

In investing there are three ways to achieve a desirable unfair competitive advantage.

- Physical: Do more work and research than others.

- Intellectual: Think more deeply and further into the future than others.

- Emotional: Maintain calm rationality at all times and never get excited by favourable market events and never get upset by adverse markets.

The easiest way is the emotional way and the best way to follow that path is to invest in index funds. The way you do it is to design a long-term portfolio that will meet two important tests:

- You can and will live with the market risks of this portfolio.

- The long-term reasonably expectable results will meet your own investment priorities.

If you do this, you have the following “unfair advantages”:

- Higher rates of return(85% of active managers underperform the market over the long run and impossible to predict in advance the top 15%)

- Lower management fees.

- Lower operating expenses.

- Lower brokerage commissions.

- Lower market impact because of lower portfolio turnover.

- No records to keep-very convenient.

- Lower taxes.

- Freedom from error or blunder because no market timing, portfolio strategy and manager selection decisions and no single stock forms a large part of your portfolio.

- Peace of mind.

- Freedom to focus on really important decisions like investment objectives and sensible long-term investment policies and practices.

- Less anxiety and concern because you never have to worry about errors of omission or commission.

These advantages accumulate as the length of investing increases.

For indexing, one can invest in mutual funds or ETFs. There are many ETFs which are active ETFs and one has to be careful in choosing the best ETFs, which usually come from Vanguard. Once you have decided to index, you have to decide which index to invest and which ETF to invest.

To minimize risk relative to return, or to maximize return relative to risk you should diversify internationally. Wise investors choose an index fund that replicates the broadest market. For fairly rational investors, this will be a broad market index fund in their own country. For very rational investors, this will be a worldwide total market index fund.

THE PARADOX

Investing for the long term is different from investing for the short term. Long term is 30-40 years for somebody at age 20. Short term is 5-10 years for somebody who is 20 years old. There will be volatility when investing for the long term. But there will be higher returns as well.

Investors and their managers should therefore devote themselves to these four things:

- Understanding each investor’s real needs

- Defining realistic investment objectives to meet those realistic needs.

- Establishing the asset mix or portfolio structure best suited to meeting those risk and return objectives.

- Developing well-reasoned investment policies to implement the strategy and achieve the particular investor’s long term investment objectives.

If we say that the long term return on stocks is 9% and bonds is 5% respectively, then compared to a 60:40 stock:bond portfolio-

- 70:30 will give you 0.4% extra return per year

- 80:20 will give you 0.8% extra return per year

- 100:0 will give you 1.2% extra return per year

But these are averages and if you do not hold long enough, which may be more than 20 years then you will not the benefit. That is why investing and how you invest is a very personal matter and this will depend on the investment goals of a particular person and not whether you want to get the returns of Warren Buffett.

Each investor should think through the answers to these six questions:

- What are the real risks to you of an adverse outcome, particularly in the short run? You should never take unacceptable risks.

- What are your probable emotional reactions to an adverse experience? When you invest in stocks there will be gains and there will be losses which will be higher in magnitude than investing in other assets. But if you do not invest in stocks, you are likely to have lower money over the long run. You miss an opportunity by not investing in stocks. Avoiding market risk has a real “opportunity cost”.

- How knowledgeable are you about the history and realities of investing and the realities and vagaries of the financial markets? Lack of knowledge makes people fearful in bear markets and greedy in bull markets.

- What other capital or income resources do you have, and how important is your portfolio to your overall financial position?

- Are there any legal restrictions on your investments?

- Are there any unanticipated consequences of interim fluctuations in portfolio value that might affect your optimal investment policy?

Based on these answers and what you really want and what market history says, you should decide on your portfolio and stick to it through thick and thin if you want to win the investment game. Then you can focus on what really matters: not the futile struggle to beat the market, but the reasoned and highly achievable goal of setting and meeting your own informed and realistic long-term investment objectives.

TIME

The time over which you invest is important. In the short run, investing in stocks is dangerous. In the long run, investing in stocks is essential. So if you are investing for the long run of more than 20 to 50 years, then stocks is where you should be if you want to have higher returns.

Conventionally it is said, that for investing horizons of:

- 5 years: 60:40 stocks:bonds

- 10 years: 80:20 stocks:bonds

- 15 years: 90: 10 stocks: bonds

- 20 years: 100:0 stocks:bonds

But for people who are investing for their kids and future generations, truly long-term thinking would suggest investment in stocks alone.

RETURNS

Investing returns depend on a few things:

- What the future profits or earnings are going to be?

- What the long-term interest rates are going to be in the future?

- What is the trend of inflation?

There is also this phenomenon of regression to the mean. So if current profits are very high/very low, future profits are going to be go down/up. If current interest rates are high/low, future interest rates are going to be low/high. If inflation increases/decreases, prices go down/up.

Interest rates are difficult to predict, but if we think we as a human race are going to continue to get better then over the long run future profits are going to be high and our investing results will depend on earnings and dividends.

In the short run, all investing is speculation and depends on change in investor psychology.

The history of returns shows that:

- Returns of stocks>bonds>money market

- Yearly return fluctuations of stocks>bonds>money market

These fluctuations get smaller as the years pass. While the fluctuations cannot be predicted, they are due to regression to the mean.

Over the period 1926-2007, the annualised return of stocks has been 10.4%, bonds 5.5%, T-Bills 3.9% and inflation has been 3%.

We have to remember that these are averages over extremely long periods of time. That is why we need to be patient and stay for the long haul. After all, a tree cannot be grown in one day.

We often like to think that if we prepare enough, we can beat the market. We have to remember that many others are doing it as well and it will be rare that you find something that others have not found. But if you think you have found a great investment opportunity, ask yourself these four questions and talk it over with other people:

- What could go really right, and how likely is it?

- What could go wrong, and how likely is that?

- Am I so confident that I plan to invest a significant part of my portfolio in this one?

- If the price goes down, will I really want to buy a lot more?

INVESTMENT RISKS

The real risk is this: not enough cash when money is really needed, especially too late in life to go back to work.

Active investors think of risk in four ways:

- Price risk: If the price is high, it can go down.

- Interest rate risk: If interest rates go up more than what is expected, price will go down.

- Business risk: The company falters, and earnings go down. Price then goes down.

- Failure risk: The company fails. You lose your money.

Academic research has shown that there are three types of risk:

- Market risk

- Individual stock risk

- Stock group risk

Market risk cannot be avoided. Individual and group stock risk can be avoided by investing in index funds.

The total return to an investor consists of:Risk free return+Market return+Stock group return+Stock return

But in reality, in the very long-term, inflation is a major risk. We have to take market risk to overcome this. But we need not be worried about short-term market fluctuations. As long as you hold for the long-term you will be alright. But you need to hold for the long-term.

BUILDING PORTFOLIOS

- Buy stocks and bonds.

- Buy indexed instruments than individual bonds and stocks.

- You can increase market risk by upto 20% while still being diversified. This will give you an incremental return of 1.2% per year. You have to remember that no mutual fund has achieved that amount of incremental return over any sustained period.

- Do not leverage. Do not maximize. Optimize.

WHY POLICY MATTERS

Your investment policy is important. This is because this is your instruction manual to tide through both bear and bull markets and prevent you from becoming too greedy or too fearful.

THE WINNER’S GAME

The winner’s game in investing is very easy:

1. Ignore the ‘beat the market’ hype.

2. Decide for yourself what investment policy will, over the long-term have the best chance of producing the particular results you want to achieve. Do not compete with the market. Compete with yourself.

The five decision levels for an investor to make are:

- Level 1: Settling on your long-term objectives and asset mix-stocks, bonds, and perhaps other assets.

- Level 2: Equity mix- growth versus value. large cap versus small cap, domestic versus international

- Level 3: Active versus passive management( passive is best)

- Level 4: Specific fund selection( Vanguard vs Fidelity etc)

- Level 5: Active portfolio management- selecting specific securities and executing transactions

If you wish to choose an active approach either yourself or using a manager, you have to ask three questions:

- How will you differentiate the portfolio( few stocks or stock groups)?

- When will you differentiate the portfolio( long term strategy or short-term tactic)?

- Why are you confident you will achieve favourable incremental results by doing the above?

You should have cash in the portfolio. Do not base your portfolio on the income you need.

Your investment policy should meet these following tests:

- Is the policy realistically designed to meet your real needs and objectives as a long-term investor?

- Is the policy written so clearly and explicitly that a competent stranger could manage the portfolio and conform to your true intentions?

- Would you have been able to sustain a commitment to the policies during the most troubling markets that have actually been experienced over each of the past 50 years-including 2008?

- Would the policy, if implemented, have achieved your long-term objectives?

PERFORMANCE MEASUREMENT

In the very long-term it is very difficult to beat the market average. In the short to intermediate term some do beat the market average. No major mutual fund has achieved a sustained 2% advantage over the market average. We have to remember that the short-term does not resemble the long-term and regression to the mean is the rule. When there is short to intermediate term outperformance it is often due to luck or chance( it requires 70 years of data to show that 2% incremental return is due to superior investment management skill than chance). Many professional investors are brilliant and it is impossible for one to beat the other over long periods of time. There is also survivor bias( good performers are included and bad performers are excluded) and new firm bias( new mutual funds are incubated and only the best performers are introduced while others are buried). The starting point of measurement is often important and sometimes when you start or end a year earlier or later, the results seem average. There is also the issue of sampling error, the style of investing for the period measured and the actual skill of the manager. Very few mutual funds in reality outperform the market average over long periods of time. Therefore it is better to stick with index funds.

PREDICTING THE MARKET-ROUGHLY

A good way to be realistic about future returns is to assume that the future range of P/E multiples and profits will be within their historical upper and lower limits and will appear with increasing frequency at values closer and closer to the mean.

The two big factors that are important for investors are:

- Corporate profits( and the dividends they provide)

- P/E ratio at which these earnings are capitalised. P/E is determined by interest rates. Interest rates are determined by expected inflation, plus an “equity premium” reflecting the uncertainty of investing in stocks, plus or minus a “speculative” factor reflecting how optimistic or pessimistic investors currently feel.

Both these will regress to the mean.

One straightforward approach to estimating return from the market is:

Total return= Fundamental return( Dividend yield+ average annual growth in earnings)+ Speculative return(change in P/E ratio)

THE INDIVIDUAL INVESTOR

There are three important realities that apply to the individual investor:

- Each individual is mortal.

- Each individual can affect their family and future generations with the gifts and bequests they make or do not make.

- Each individual is affected by inflation.

Also, individual investors have responsibilities: educating children, retirement costs, pay for healthcare, contribute to institutions they like, self-defense against illness and catastrophe and also leave something to their children and grandchildren. These commitments vary and only you can decide how much to commit for these various things.

To invest we have to save. The more we save, the more we can invest. Therefore we should underspend. One powerful way to save is to limit your spending to last year’s income. You should also have an emergency fund for emergencies and you should be happy to spend it all if the emergency arises. The funds available for long-term investment should be kept in stocks for the long-term. The long term may be “forever” if the aim to provide more wealth for future generations.

If stocks go down-by quite a lot- and stay down for several years, it is better in the long run than if stocks go up-by quite a lot- and stay up for several years. This seems counterintuitive but it is true.

The main secret of successful investing is- Don’t lose! Don’t swing for the fences. Don’t invest with borrowed money. Don’t be excited by rising markets. Don’t be depressed by falling markets. Benign neglect, for most investors is the secret to long-term success in investing.

Review once a year your investment objectives, financial resources, financial responsibilities, and recent investment results compared with prior realistic expectations and rebalance your investments. Examine your savings, insurance, bank credit available, current debts, probable obligation to help or support others in your “we” group, annual income versus expenditures, and estate plans. If you have funds for all your chosen responsibilities and obligations, you have won the money game.

Once you have won, do not take excessive or be too careful. It takes a great deal of boldness and a great deal of caution to make a great fortune; and when you have got it, it requires ten times as much to keep it.

These 10 commandments will be useful to you as an individual investor:

- Save. Invest your savings in you future happiness and security and education for your kids.

- Don’t speculate.

- Don’t do anything in investing primarily for tax reasons. Tax shelters are poor investments. Tax loss selling is primarily a way for brokers to increase their commissions. Keep bonds in tax sheltered retirement funds.

- Don’t think of your home as an investment.

- Don’t do commodities.

- Don’t get confused about stock brokers and mutual fund salespeople. They are usually nice people but their job is to make money from you.

- Don’t invest in new or “interesting investments. They are all too often designed to be sold to investors, not to be owned by investors.

- Don’t invest in bonds just because people say they are conservative and safe. Bonds are a poor defense against the major risk of long-term investing inflation.

- Write down your long-term goals, your long-term investing program and your estate plan annually and every decade.

- Distrust your feelings. Do not be fearful or greedy.Do not invest in your own company. Remember that is impossible to select the best active managers and that past performance does not predict future results. Therefore invest in index funds.

SELECTING FUNDS

There are three things that you can do:

- Use index funds.

- Buy individual stocks.

- Use actively managed funds.

The data that exists shows that most actively managed funds underperform the index funds. People who buy individual stocks have to be brilliant than the scores of brilliant fund managers to really outperform. So, for almost all people it is best to buy index funds and leave it at that. If you want to buy active funds or stocks, you should really know better than others. Will you know? I have little confidence. But if you want to invest in an actively managed fund, then make sure it will stay around for a long time and has stayed around for a long time. It should have low portfolio turnover and low expenses. And you should have faith to stick with it for the long run and even increase your commitment to it if it falls in value.

PLANNING YOUR PLAY

If your investing horizon is longer than your life horizon, then you want to be 100% in equities rather than put some money in bonds. But you have to be really sure of that.

There are two risks in investing: Market risk and inflation risk. Inflation risk is real and decreases the value of what you have constantly.

Your aim is to have a good standard of living in retirement, have sufficient financial reserves for crises in old age and be able to give to heirs and charities.

The key things are to get out of debt and to be thrifty and save.

The five unknowns in investing are the rate of return on our investments, inflation rate, spending rate, taxes and the time we have on our hands. Historically stocks have given the highest rate of return over long periods of time.

How to withdraw money from your portfolio?

There are three options:

- Limit annual withdrawals to 4% of a three-year moving average of your portfolio.

- If you have to take a 5% withdrawal, then at retirement put a rolling five years expenditure in medium term bonds and the rest in equities. Each year convert one more year of spending from equities to bonds. If people think the prospects for stock markets are good, convert 2 years and if they think the prospects for stock markets are great, convert 3 years. Yes, this is a form of market timing but is contrarian thinking.

- If you spend 6% of your money every year, you will run out of money.

It may be useful to ask these questions every year:

- How much income do I want for each year of retirement and where will I get it from?

- How many years will I be in retirement?

- What is the spending rule I will adopt?

- How much capital I will need?

- How much insurance I will need?

- How much money I am going to leave to my family and friends?

- How much money I am going to give to philanthropy?

The long-term returns for each of the asset classes are( after inflation):

- Stocks:4.5%

- Bonds: 1.5%

- T-Bills: 1.25%

- Any funds that are going to be invested for 10 years or more should be in stocks.

- Any funds that will be invested for less than two to three years should be in “cash” or money market instruments.

You have to make the plan and stick to the plan for the long run.

DISASTER-AGAIN

The tragedies of Madoff and Iceland are a stark reminder that nothing is really free. We all have to make a plan and stick to it. We need to understand that markets will be volatile.

ENDGAME

Money is not everything but money is important. We can give our money to others- either family or the world so that they can benefit. There are methods which help us do that and thereby avoid a lot of tax. To create wealth we need to earn, save, invest, contribute and plan our estate. You can save a lot of tax by giving. therefore give.

THOUGHTS FOR THE WEALTHY

If you have more than 20 million dollars you are really wealthy. To protect your wealth you need to have an investment committee or a personal expert(if you have more than 100 million). You should also have a fine trust and estate lawyer and a brilliant book keeper. Be wary of asset gatherers and stay away from them.

Alternative investments, hedge funds, venture capital are touted a lot. The best firms are usually closed to new investors. Real estate can create a lot of wealth, but you need to spend a lot of time at it. REITs may be an easier way. Commodities are really not great investments in the long run.

YOU ARE NOW GOOD TO GO!

- Active managers cannot beat the market over the long run.

- The winner’s game is to concentrate on your long term objectives, asset mix and investing policies- and stay the course.

- Investing is simple-but not easy. Indexing is the best. Think long term.

PARTING THOUGHTS

There are three realities that will stay:

- There are many brilliant professional investors.

- Most transactions are done by institutions.

- Unless everybody decides to index, stock picking cannot win.

Therefore you can index and win.

The author then talks about how to serve on an investment committee and recommends ten choices for reading:

- Berkshire Hathaway annual reports

- The Intelligent Investor and Security Analysis by Benjamin Graham

- John Bogle on Investing: the First 50 years by John Bogle

- Pioneering Portfolio Management by David Swensen

- Why Smart People Make Big Money Mistakes- and How to Correct Them by Gary Belsky and Thomas Gilovich

- The Crowd by Gustave Le Bon

- The Only Investment Guide You’ll Ever Need by Andrew Tobias

- A Random Walk Down Wall Street by Burton Malkiel

- An Investor’s Anthology by Charles Ellis

- Wealthy and Wise by Claude Rosenberg

He also recommends four journalists to watch out for:

- Carol Loomis of Fortune

- Floyd Norris of New York Times

- Jason Zweig of Wall Street Journal

- Consuelo Mack on TV